Earned income credit calculator 2021

With two eligible children. In some cases the EIC can be greater than your total income tax bill.

Eic Earned Income Credit Calculator For 2021 2022

For the 2021 tax year the earned income credit ranges from 1502 to 6728 depending on tax-filing status income and number of children.

. Sans Frais de Dossier. The Earned Income Tax Credit EITC helps low to moderate-income workers and families get a tax break. Taxpayers with low earnings by reducing the amount of tax owed on a dollar-for-dollar basis.

Earned income credit New York State Important for 2021. For purposes of calculating the Earned Income Credit EIC unemployment is not included in earned income but is included in Adjusted Gross Income AGI. Its fully refundable so you can get money from the Federal government even if you dont owe them.

The advance Child Tax Credit payments were signed into law as a part of the American Rescue Plan Act in 2021. The Earned Income Credit is one of the most beneficial tax credits available today. Provide the following information and.

Under the Biden ARPA package the EITC was temporarily modified to provided greater coverage for childless workers and also boost the maximum credit in 2021 to 1502. Answer some questions to see if you qualify. You may fall into that.

Ad Souscrivez 100 en ligne. Election to use prior-year. The maximum amount you can get from this credit is 6728 for the 2021 tax year which is a moderate increase from 2020.

If you elected to use your 2019 earned income in calculating your 2021 federal earned income credit you must also use your. Child Tax Credit EITC and More Supported. Earned Income Tax Credit EIC Calculator Earned Income Credit EIC is a tax credit available to low income earners.

Demande de Crédit 100 en Ligne - Report Modification de Mensualités. With three or more eligible children earned income and adjusted gross income AGI must both be less than 51464 57414 married filing jointly. Earned Income Tax Credit Calculator.

No Hidden Fees Upfront Costs. Use the EITCucator Dollar Amount tool below to help you determine how much your Earned Income Tax Credit may be with your 2021 Return due in. Required Field How much did you earn from your California jobs or self-employment in.

You can use this EIC Calculator to calculate your Earned Income Credit based on the number of qualifying children total earned income and filing status. What Might your Earned Income Credit Be. Earned Income Credit EIC is a tax credit available to low income earners.

FreeTaxUSA has what you need. The earned-income credit EIC is a refundable tax credit that helps certain US. Crédit Sans Frais Caché.

Claiming the credit can reduce the tax you owe and may also give you. Universal sunroof for sale who. For the 2021 tax year the earned income credit ranges from.

Sign Up Now before deadline. If you choose to. The tool below is to only be used to help you determine what your 2021.

The earned income tax credit also known as the EITC or EIC is a refundable tax credit for low- and moderate-income workers. For 2021 you can elect to use your 2019 earned income to determine your 2021 Earned Income Tax Credit if your 2019 earned income gives you a higher tax credit. Ad Claim the Credits and Deductions You Deserve.

Find out how much you could get back Required Field. In some cases the EIC can be greater than your total income tax bill providing an income tax refund to families that. However most people wont be able to claim the full.

To calculate your allowable EIC for 2021 you can use either your 2019 earned income or your 2021 earned income whichever will give you a bigger credit. Earned Income Credit Calculator for 2021 2022 Home Earned Income Tax Credit Calculator Earned Income Tax Credit Calculator The Earned Income Credit EIC is a tax credit available. Find out if you are eligible.

If your AGI results in a lower. Estimate how much tax credit including Working Tax Credit and Child Tax Credit you could get every 4 weeks during this tax year 6 April 2021 to 5 April 2022. Ad Business can receive an avg of 144300 through the this ERTC Tax Credit.

In 2022 the range is 560 to 6935. This can be from wages salary tips employer-based disability self-employment income military pay or union strike benefits. IRS E-File Fast Refunds Always Free.

Earned income includes all the taxable income and wages you get from working for someone else yourself or from a business or farm you own. The first is that you work and earn income. The Earned Income Tax Credit EITC helps low-to-moderate income workers and families get a tax break.

Earned Income Credit Calculator H R Block

2021 Child Tax Credit Calculator How Much Could You Receive Abc News

Pin On Deku X Froggy

.jpg)

Income Tax Calculator Estimate Your Refund In Seconds For Free

Income Tax Calculator Estimate Your Refund In Seconds For Free

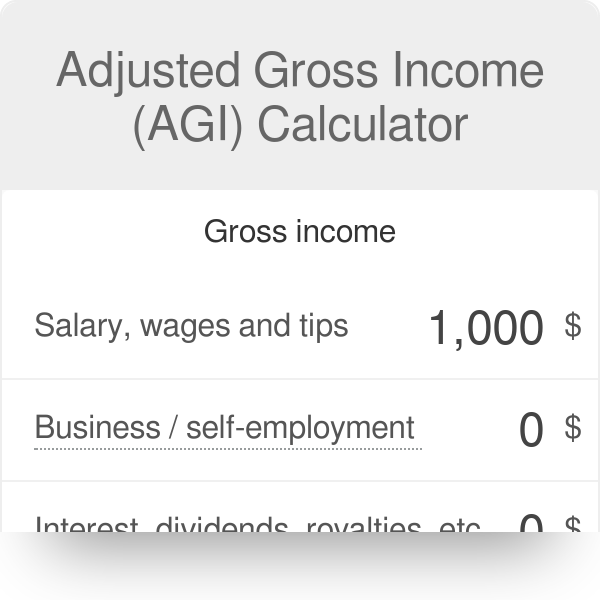

Agi Calculator Adjusted Gross Income Calculator

Should You Move To A State With No Income Tax Forbes Advisor

Free Tax Resources Tools And Tips To Simplify Tax Season Lili Banking

Simple Tax Calculator To Determine If You Owe Or Will Receive A Refund

![]()

1040 Income Tax Calculator Free Tax Return Estimator Jackson Hewitt

What Is My Tax Bracket 2021 2022 Federal Tax Brackets Forbes Advisor

Monthly Gross Income Calculator Freeandclear

70trades Review Website Check Online Trading Trading Brokers Mobile Application

Schedule C Income Mortgagemark Com

Federal Income Tax Calculator Find Your Irs Refund Payment For Your Return

How To Calculate Taxable Income H R Block

Earned Income Tax Credit Calculator Taxact Blog